Everton FC Shares Information

| Who currently owns Everton Shares? | |

| A fiscal roller-coaster story of questionable accuracy | |

| Just as it says. Follow the link for more info. | |

| ToffeeWeb News report on the AGM held in January 2021 | |

| ToffeeWeb News report on the AGM held in January 2020 | |

| ToffeeWeb News report on the AGM held in January 2019 | |

| ToffeeWeb News report on the AGM held in January 2018 | |

| ToffeeWeb News report on the AGM held in January 2017 | |

| ToffeeWeb News report on the AGM held in November 2015 | |

| The AGM is reinstated in April 2014 for FY 2012-13 | |

| Shareholders force EGM held in June 2013 | |

| A Transcript on the EGM held in September 2008 | |

| A Report on the AGM held in December 2007 | |

| A Report on the AGM held in December 2006 | |

| A Report on the AGM held in November 2005 | |

| A Report on the AGM held in December 2004 | |

| A Report on the EGM held in September 2004 | |

| A Report on the AGM held in October 2003 | |

| A Report on the AGM held in October 2002 | |

| A Report on the AGM held in December 2001 | |

| Phil Pellow's Report on the AGM held in December 2000 | |

| Report on the AGM held in September 1999 | |

|

|

|

Share Ownership

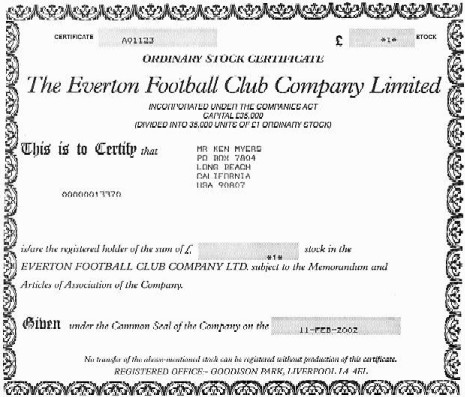

Shares in Everton FC Co Ltd are closely held. They are privately traded and do not often become available, rare transactions generally being through the club's brokers, Blankstone Sington. There is no official share price, so the cost of shares is governed by how much one is prepared to sell or pay for them, with the price dropping significantly for bulk lots. Individual shares were changing hands for somewhere in the range of £1,400 to £2,000 prior to the arrival of Farhad Moshiri but a subsequent increase in value has elevated prices to around £3,500.

Farhad Moshiri, Majority Shareholder

The purchase of a 49.9% stake in Everton by British-Iranian billionaire Farhad Moshiri in February 2016 for a reported £85M increased the nominal share value to around £4,850, although there has been no clarification of the final sum the former Arsenal investor paid for his 17,465 shares.

The primary beneficiary following Moshiri's arrival as the investor Bill Kenwright had sought for most of the preceding 15 years included Kenwright himself and Jon Woods, who both sold around half of their holdings, with Moshiri buying out Robert Earl's entire holding of Everton shares.

In September 2018, Farhad Moshiri increased his stake in Everton Football Club to 68.6% of the 35,000 outstanding shares. The 18.7% stake acquired by Moshiri was made up of Jon Woods's 3,000-plus shares and former director Arthur Abercromby's 909 shares, plus half of chairman Bill Kenwright's shareholding. Jon Woods stepped down as a Director in July 2019.

In June 2019, Farhad Moshiri further increased his stake to 77.2%, buying up shares held for many years by Lord Grantchester and his family.

By the autumn of 2020, Farhad Moshiri had pumped an incredible amount of money into the club over 4½ years. He contributed an additional £50m in the 2019-20 accounts, taking his total investment to £350m by 30 June 2020, then providing a further £50m by November as the financial impacts of the Covid-19 pandemic wreaked havoc to the club's finances.

To consolidate his investment and convert it into capital holdings, shareholders were asked to support the issue of up to 100,000 new shares to Moshiri's Blue Heaven Holdings Ltd to the value of £300m in exchange for cash injections and the conversion of pervious loans into share equity. This move takes Farhad Moshiri's ownership of Everton above 90%,

Recent holdings of directors and major shareholders

| 2021 | 2020 | 2019 | 2018 | 2016 | 2014 | 2008 | |

|---|---|---|---|---|---|---|---|

| Farhad Moshiri* | 93,698 | 27,031 | 23,997 | 17,465 | – | – | – |

| Bill Kenwright | 1,750 | 1,750 | 1,750 | 1,750 | 4,256 | 9,044 | 8,754 |

| Lord Grantchester | – | – | 2,773 | 2,773 | 2,773 | 2,773 | 2,773 |

| Robert Earl | 8,146 | 8,146 | 8,146 | ||||

| Others | 6,219 | 6,219 | Jon Woods | 3,116 | 6,622 | 6,622 | |

| Sir Philip Carter | 714 | 714 | 714 |

*Ultimate beneficial owner (UBO) of Blue Heaven Holdings Limited

Paul and Anita Gregg left the Everton Board after selling their shares to Robert Earl in 2006. Sir Philip Carter (714 Shares), Keith Tamlin (119 Shares) and Arthur Abercromby (1,935 Shares) all left the Board in the summer of 2004, with Sir Philip Carter returning in August 2008 until his death in 2015. His shareholding is believed to remain with his estate.

The estimated share value in January 2015 was not much increased from the £1,200 reputedly paid by Robert Earl for the Greggs' shares in 2006. With 35,000 shares outstanding, this gave the club a nominal book-value of around £30m. At that time, almost 25,000 Everton shares were held by True Blue Holdings, the consortium Bill Kenwright put together (with the help of Paul Gregg and John Woods) to buy out Peter Johnson in 1999 (see below). TBH was voluntarily wound up on 2 December 2004. Paul Gregg and family later sold their approximately 8,146 Everton shares, making around a £2m profit on their £7m investment in the Club.

Lord Grantchester (a member of the Moores Family) until recently owned 2,773 (7.9%)

Everton shares; however he and his family sold their shares

to Farhad Moshiri in June 2019. That leaves around 2,000 shares owned by small shareholders with as few as one share each.

Earlier Share History

For our ToffeeWeb readers, we have collated an approximate history of Everton share prices and related activity (in reverse chronological order) going back to the end of the Moores Era in 1994.

October 2009: Nearly three years since the last entry in this record... and hardly any change to report. One intrepid contributor found that the ownership of the club's shares is actually more complex than we have presented previously in more simplified versions that group together ownership by individuals registered under more than one different name in the database:

| EFC Share Ownership | £ | |||

| BCR Sports Ltd | 8,146 | 23% | 16,292,000 | |

| Bill Kenwright Ltd | 7,053 | 20% | 14,106,000 | |

| 3,209 | 9% | 6,418,000 | ||

| Jon Woods Ltd | 3,203 | 9% | 6,406,000 | |

| 2,773 | 8% | 5,546,000 | ||

| 1,830 | 5% | 3,660,000 | ||

| Bill Kenwright | 3% | 1,946,000 | ||

| Barnett Waddingham Trustees Scotland Ltd | 973 | 3% | 1,946,000 | |

| 714 | 2% | 1,428,000 | ||

| William Kenwright | 473 | 1% | 946,000 | |

| All Others | 5,653 | 16% | 11,306,000 | Small Everton Shareholders |

| Total | 35,000 | 100.0% | £70,000,000 | Based on £2,000 share value |

December 2006: Paul and Anita Gregg sold their shares to BCR Sports Ltd, believed to be a front company belonging to Robert Earl.

December 2004: With the voluntary liquidation of True Blue Holdings, the individual holdings of their 22,031,351 shares were converted directly to Everton Shares resulting in the following breakdown of EFC Ownership:

| EFC Directors | ||||

| Kenwright | 8,754 | 25.0% | £7,501,974 | |

| Woods, J | 6,622 | 18.9% | £5,675,487 | |

| Gregg, P | 3,779 | 10.8% | £3,238,376 | Plus 12.5% from wife & son? |

| Others | ||||

| Abercromby | 1,935 | 5.5% | £1,658,664 | |

| Grantchester | 2,773 | 7.9% | £2,376,461 | |

| Carter | 721 | 2.1% | £617,897 | Sir Philip Carter, Life President |

| Tamlin | 119 | 0.3% | £101,983 | Keith Tamlin, ex-Director |

| Gregg, A | 4,075 | 11.6% | £3,491,880 | Paul Gregg's Wife, Anita |

| Gregg, D | 292 | 0.8% | £250,109 | Paul Gregg's Son |

| Other ex-TBH | 406 | 1.2% | £348,102 | Jimmy Mulville, Willy Russell |

| All Others | 5,224 | 15.8% | £4,734,068 | Small Everton Shareholders |

| Total | 35,000 | 100.0% | £29,995,000 | Based on £857 share value |

Immediately after the 2004 AGM, Anita Gregg was appointed to the Everton Board of Directors.

May 2004: With the departures of Carter, Tamlin and Abercromby from the Everton Board of Directors, the direct shareholding in EFC at Board level was reduced to around 2%; however, the remaining three directors (Kenwright, Gregg and Woods) held 75% of shares in TBH (or more, if you added in shares controlled by other members of the Gregg family – see above), giving the individual Board members collectively the equivalent of around 55% control in EFC.

2003: With Everton's stock increasing under David Moyes, Everton shares were changing hands privately for between £1,500 and £2,000.

2002: If you knew the right contacts, you could get a share in Everton for under £1,500, but the number of shares held outside the Board / TBH hovered around 5,500, or just 15%.

2001: With stability finally assured, share prices crept back up to around £1,250.

2000: A deal is finally struck, at a remarkable share

price of just £857, which enables the Kenwright consortium of True Blue

Holdings to buy 24,986 EFC Shares establishing a 70% controlling interest

in the Club for a 'mere' £20M, sending Agent Johnson packing... albeit

with a very tidy profit! The control of TBH is a whole other issue,

the holding company having issued 22,031,351 shares nominally valued at £1

each, distributed as follows:

| TBH Directors | ||||

| Kenwright | 7,228,359 | 32.8% | £7,025,482 | |

| Abercromby | 1,613,978 | 7.3% | £1,568,679 | |

| Woods, J | 5,648,922 | 25.6% | £5,490,375 | |

| Gregg, P | 3,331,891 | 15.1% | £3,238,376 | |

| Gregg, A | 3,592,716 | 16.3% | £3,491,880 | Paul Gregg's Wife, Anita |

| TBH Others | ||||

| Gregg, D | 257,331 | 1.2% | £250,109 | Paul Gregg's Son |

| Others | 358,154 | 1.6% | £348,102 | Jimmy Mulville, Willy Russell |

| Total | 22,031,351 | £0.97 | £21,413,002 | £1 shares |

1999: A period of profound uncertainty sees the real value of the shares drop to around £1,000 as no-one seems interested in taking on the floundering monster that is Everton FC.

1998: The share price sinks further to £2,500 amid rumours of financial problems for Johnson, who is seeking to sell up his interest in a rapidly falling market.

1997: Share prices soften to around £3,000, with serious concerns being raised about Everton's long-term viability in the cut-throat Premier League.

1996: Peter Johnson orchestrated a substantial 6-for-1 Rights Issue of 30,000 new £500-shares in September, increasing the total number of shares to 35,000, most of which Johnson underwrote for an additional investment of around £15M in the club. A further 5,000 shares were issued at the peak of the Premiership moneyfest, with shares supposedly changing hands for as much as £4,000, that would have valued the club at close £100M. At the peak, Johnson sold 17% of his holding, netting perhaps as much as £20M and reducing his stake to 68%.

1994: There was a straight 2-for-1 stock-split in July 1994, the resulting 5,000 shares worth nominally £4,000 each. This article from 1994 suggests this was in fact a rights issue that was part of the scheme for Peter Johnson to buy into the club and provide it with operating capital.

1993: At the end of the Moores era, there were just 2,500 shares in EFC, and they changed hands (rarely!) for between £2,600 to perhaps as much as £5,000 each, giving the club a nominal maximum book value of up to £20M. Lifelong Liverpool fan Peter Johnson bought 50% of them for around £10M to take control of the Club. Johnson then bought a further 875 shares from John Moores Jr, giving him an unassailable 85% controlling interest.

New Share Issue?

Prior to the influx of foreign billionaires to the Premier League, starting around 2003 with Roman Abramovich, and the unprecedented explosion in broadcast revenues enjoyed by top-flight clubs in England, many Everton fans felt that a share issue could have brought in much-needed cash to fund key initiatives such as ownership of the new Academy and training centre at Finch Farm (subsequently purchased as an investment by Liverpool City Council); establishment of the Everton Collection, and perhaps even money towards a new or improved stadium.However, there were few signs that such an initiative, carrying as it would a necessary dilution in the shares of the existing major shareholders, was ever considered by Bill Kenwright's regime. That remained the situation since Kenwright assumed control of the club in 2000. The club could have used the extra money but the Directors clearly did not want to voluntarily reduce their own personal worth (if this was indeed a risk), especially as Everton's stock value was rising again under Roberto Martinez and the new £5.136m billion domestic TV deal struck in 2014.

Things seemed set to change, albeit briefly, following the dismal 2003-04 season, when Everton contrived to survive relegation with their smallest ever points total recorded at Goodison Park, followed by the meltdown at Board level as Paul Gregg faced off against Bill Kenwright to get TBH dissolved and allow further investment in the Club – including a £15m rights issue he wanted to be bought up by the fans.

The much-vaunted promise of investment from Christopher Samuleson's Fortress Sports Fund would've given FSF a 29.9% stake in the resulting company, increasing its book value to over £42m. However, this would've taken the Club in the opposite direction of increased ownership by the fans – something that was pursued in depth by Trust Everton as an alternative to the negativity promoted by the Blue Union movement, who wanted Kenwright to sell up.

These groups lacked broad support among Evertonians loyal to the concept of a 'fellow' fan at the helm, and subsequently faded into the internet ether while Kenwright successfully resisted any and all attempts by those beneath him to change things until 2016 when he substantially reduced his stake in the club with the arrival of Farhad Moshiri.

2005 Fortress Sports Fund Controversy

With the dissolution of True Blue Holdings confirmed in early 2005, the much-heralded investment promised by Bill Kenwright appeared to be forthcoming from Swiss-based financier Christopher Samuelson and Fortress Sports Fund, a Brunei-based entity set up for a select group of international investors to put their money into promising sports ventures, not the least of them being Everton FC. This proposal was supposed to work as follows:Tranche 1: FSF wanted to invest initially £12.8m in the form of new shares (approximately 14,936 at £857) that would give them a 29.9% stake in the resulting company, increasing its book value to over £42m. For this to happen, there would have had to be a vote by existing shareholders (at a new EGM), 75% of whom would have had to approve the deal.

The concern amongst shareholders (primarily Paul Gregg) was that this would dilute his holding in Everton, and limit the power he could exercise. By calculations, he and his immediate family members commanded 23.3% of Everton shares at the time (see above); so, with a strategic alliance, it would have been relatively easy for him to garner more than the 25% needed to defeat any motion for the issuance of new shares that was required to make the FSF deal a reality.

If Tranche 1 had gone ahead, the total number of Everton Shares would have risen to around 50,000, with the additional investment boosting the value of the company in such a way that the individual value of shares (and therefore the share price) should not be adversely affected. The power balance would shift, however, with Kenwright's 25% slipping to 17.5%, the Gregg family to 16.3%, and so on. The minor shareholders would have represented only 11.1% of the cub ownership.

Tranche 2: FSF then wanted to invest another £17m a year or so down the road, in the form of more new shares (approximately 20,164 at £857) that would give them overall a 50.1% stake in the resulting company, increasing it's book value to over £60m. There would presumably have needed to be another vote by existing shareholders, 75% of whom must approve the deal.

If Tranche 2 had followed, the total number of Everton Shares would likely have risen to around 70,100, with the additional investment boosting the value of the company in such a way that the individual value of shares (and therefore the share price) would not be adversely affected (we are still working on Bill's quoted figure of £857). The power balance would have suffered another seismic shift, with Kenwright slipping to 12.5%, the Gregg family to 11.6%, and so on. The minor shareholders would have represented a paltry 7.9%. Hardly the direction of a Supporters Trust...

Despite Kenwright's assurances to Everton supporters that the FSF cheque would be hitting the club's bank accounts "in the next 48 hours", the investment never materialised. In December 2005, Paul Gregg is reported to have said that the FSF deal was "dead in the water" but the controversy would live on in the minds of supporters as a curious episode om the history of the club's boardroom affairs.

It was eventually exposed, by admission of a club official, as an elaborate ruse to oust Paul Gregg from the Everton Board. It might not have succeeded immediately but, together with the collapse of the King's Dock, it had driven an irrevocable wedge between the Chairman and the Greggs who sold their stake in Everton in 2006 to leisure magnate Robert Earl for around £7m.