A couple of weeks ago I wrote about why Everton’s ownership issues needed resolving urgently and why John Textor was not the answer to our many problems as a football club even if seemingly, to Moshiri at least, it appeared to be an answer to his problems. There is, of course, a difference between the needs of Everton and that of our now very distant owner, Farhad Moshiri. The article can be found here.

I’m hoping this article proves to have a short shelf life, either because a more suitable purchaser steps forward or (perhaps optimistically) Moshiri recognises the folly of putting Textor forward as a credible owner.

If anything has changed in the last two weeks it is that the urgency to replace Moshiri has become even more apparent. Whilst almost inevitably, I have focused on the off-pitch situation, the start to the season on the pitch, Dyche’s comments and the impasse regarding transfers in and out of the club and/or contract extensions – including the manager have highlighted the fragility of Everton’s position. We don’t have the funding to add to a painfully thin squad, and the future of the club is so uncertain that the likes of Dyche and DCL are not prepared to commit their careers further to a cause they both have backed and contributed to significantly in the near past. Whether a change of ownership alters their position will be very much down to who the new owner might be. Beyond that, the further disposal of player assets remains high on the agenda — confirmed by Dyche himself.

John Textor

And so to John Textor, who depending upon the source, has, had or never had an exclusivity period with Farhad Moshiri. For what it is worth, I understand he had a brief period of exclusivity in which he had to demonstrate how he would extract himself from the complex ownership and capital structure of Crystal Palace. That exclusivity ended mid-week, last week with no apparent progress made.

Let’s, as briefly as possible, deal with Crystal Palace first as, regardless of any other issues, his part-ownership of Palace is the first and most significant barrier. Any individual, corporation or other form of legal entity owning more than 9.9% of a Premier League club cannot, under any circumstances, own a single share in another Premier League club. That’s an established fact.

Crystal Palace’s ownership is extremely complex, as is the structure of Textor’s primary football-related vehicle, Eagle Football Holdings. Let’s start with Eagle Football Holdings. Eagle Football Holdings has several names familiar to observers of football ownership and financing.

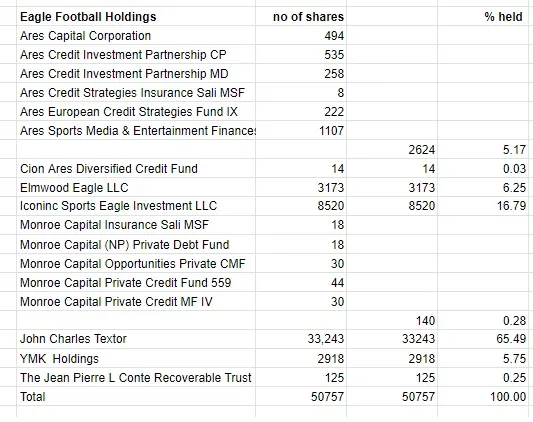

Those names include Ares, Iconic Sports, Monroe Capital, YMK Holdings LLC (Michele Kang’s acquisition vehicle) and John Textor. All figures as per the last confirmation statement :

Maybe it is old fashioned to believe in only having an interest in one club — and I am acutely aware of the Moores’ family concurrent shareholdings in Liverpool and Everton many years ago — but each of the Eagle Football Holdings' shareholders above have non-aligned interests by virtue of financial interests across multiple clubs.

To compound that potential misalignment amongst shareholders, Eagle Football Holdings has interests in four football clubs, through a subsidiary company Eagle Football Holdings Bidco Limited. “Eagle Football” has invested in Crystal Palace, Brazil’s Botafogo de Futebol e Regatas, the Belgian club, RWD Molenbeek, and, perhaps most significantly Olympique Lyonnais.

Multi-club v single club ownership

Textor is a huge advocate of the multi-club model. However that view (and we will look at Palace’s ownership in a moment) differs with that of Steve Parish, the Crystal Palace Chair, who quite rightly questions where Textor’s most significant interests lie? In the sole interest of Crystal Palace or that of Eagle Football Holdings? What happens when a decision has to be made which might conflict between the two? It’s a question which lays bare the greatest weakness of the multi-club model — good for the collective business may not be the best for the individual club. There is not (and never can be) a true alignment of interests.

If, in the unlikely event it was to happen, Everton were part of the multi-club model, exactly the same issues would arise.

Textor and Palace

Crystal Palace has an extraordinarily complex shareholding and capital structure. Something in common with Eagle Football Holdings and should (in my opinion at least) always raise the eyebrows of a potential buyer or new investor. Unnecessary layers of companies with common ownership and directors is a concern.

CPFC Limited have the following directors: Sean O’Loughlin, David Blitzer, John Harris, Steve Parish and John Textor. They, in turn, are owned by CPFC 2010 Limited with the same board who in turn are owned by Palace Midco UK limited, owned by Palace Holdco Limited – all with the same directors.

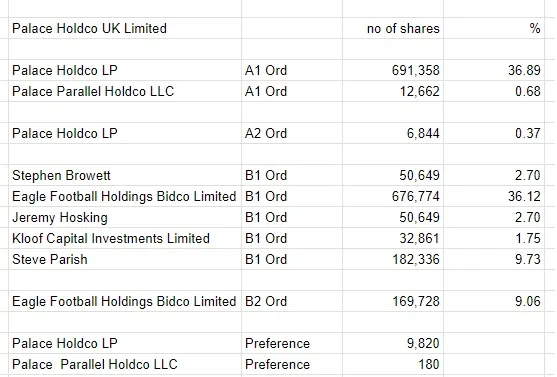

Palace Holdco is owned under the following complex structure:

The A and B Ordinary shares carry voting rights and rank equally. The preference shares carry no rights regarding general meetings nor votes. However the voting rights in the ordinary shares are effectively 25% for each of David Blitzer, John Harris, Steve Parish and John Textor’s Eagle Football Holdings.

Therefore Eagle Football Holdings Bidco Limited, although owning 45.18% of the ordinary shares, effectively only have 25% voting control. It should be noted that it is often quoted that Textor owns 45% of Palace. This, as evidenced by the confirmation statements, is not the case. Textor owns 65.49% of Eagle Football Holdings – therefore his effective economic interest in Palace is 29.6%.

It should also be noted that the Palace Holdco UK limited shares are used as security, secured by a charge in favour of Mgg Lux Waterford SARL – a Luxembourg company ultimately owned by Kevin Griffin and Greg Racz, acting as security agents for a £36 million loan.

There is conflict between Parish (Palace’s Chair) and Textor in terms of the multi-club model and its potential for conflicts of interest, although it should be pointed out that Parish was willing to accept Eagle Football Holdings' money.

All of the above makes the sale of Textor’s interest in Palace difficult, both in terms of structure and valuation. Similarly in trying to gain control of Palace, Textor has been unable to persuade his co-shareholders to accept his valuation of the club.

As a result it makes for a significant barrier to Textor’s wanting to purchase Everton.

Textor’s ability to fund an Everton acquisition

As I have stated previously, Eagle Football Holdings' acquisition of Olympique Lyonnais was funded through debt – approximately 90% of the capital commitment. Eagle Football Holdings accounts do not suggest there is access to large amounts of cash and, indeed, reports yesterday from L’Equipe claim that Textor was scrambling to raise $112 million through player sales at Lyon to comply with financial regulations from the French soccer regulatory body, the DNCG. In balance, Textor has refuted the report, telling Reuters, “We do not have sales targets, and we are not required to sell 100 million euros of players as there may be other ways to bring in revenues to maintain financial sustainability.” However, the case remains that financial compliance at Lyon is problematic and across the wider group cash is not plentiful. Part of the security offered for the Olympique Lyonnais acquisition is indeed their holdings in Crystal Palace.

Given Everton’s extreme cash requirements, it would seem the last thing we require is a purchaser relying on debt, possibly even greater debt than Everton already carry.

Textor’s interests elsewhere

Textor is reportedly a dollar billionaire. Yet there are questions to be asked about this. In Part II, I will cover some of his dealings before his involvement in multi-club football operations, how he developed his business operations and his connections around the globe.

It is not a comforting read about a potential owner, chosen by Moshiri – the continuation of a well established pattern.

This article was originally published at theesk.org and is reproduced here by permission for the benefit of ToffeeWeb readers.

Reader Comments (4)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer ()

2 Posted 13/09/2024 at 05:15:10

Is there I wonder a realistic alternative who may still be interested in stepping in, even after, or perhaps due to the absolute joke of a club we've been turned into?

3 Posted 13/09/2024 at 17:08:47

Paul (2) - I used to be "Team MSP". Now I'm holding out for "Team Friedkin".

4 Posted 14/09/2024 at 17:50:57

Add Your Comments

In order to post a comment, you need to be logged in as a registered user of the site.

Or Sign up as a ToffeeWeb Member — it's free, takes just a few minutes and will allow you to post your comments on articles and Talking Points submissions across the site.

How to get rid of these ads and support TW

1 Posted 12/09/2024 at 23:52:43

Kenwright benefitting himself by £tens-of-millions when he sold us out after his own lengthy calamitous ownership turned out very quickly to have been akin to putting OUR club on the plank in terms of our very survival.

Moshiri still has us all on that plank as we near its very end, and Textor increasingly seems to be yet another total planker when it comes to the benefit of OUR club.

"Depressing" doesn't begin to cover it.