The Everton takeover saga rolls on. The latest developments involve John Textor talking openly to the media about his desire to buy Everton and how he plans to go about achieving it.

I want to make it clear, to Everton fans in particular, that examination of a potential purchaser’s claims should be viewed as a necessary part of the fans’ role in protecting an asset which emotionally and spiritually if not legally or from an investment perspective is ours, our parents, and our children’s. Particularly when the current custodians, Farhad Moshiri and his board have, by virtue of previous potential investor choices, acting with great negligence and without any duty of care towards the club that is dear to us all.

John Textor, to his credit, has engaged with the media and that at least, has to be acknowledged. However that alone, and I am sure John would agree with me, doesn’t excuse or dismiss the need for scrutiny. This is particularly true when Everton’s position under Moshiri is so perilous. We don’t have the time, let alone the opportunity cost, to have further abandoned takeover attempts.

Let’s start from the top – John Textor’s ownership interest in Crystal Palace Football Club. Textor’s interest is through Eagle Football Holdings Limited, a UK domiciled company of which Textor owns 65.49%. Eagle Football Holdings Limited owns 45.18% of the ultimate holding company that owns Crystal Palace. That ownership confers a 25% voting stake.

Therefore, John Textor is what is referred to in the Premier League Handbook as having a significant interest.

Rule A.1.235. “Significant Interest” means the holding and/or possession of the legal or beneficial interest in, and/or the ability to exercise the voting rights applicable to, Shares in the Club which confer in aggregate on the holder(s) thereof 10% or more of the total voting rights exercisable in respect of any class of Shares of the Club. All or part of any such interest may be held directly or indirectly or by contract

including, but not limited to, by way of membership of any Concert Party, and, for the purposes of determining whether an interest or interests amounts to a “Significant Interest”:

(a) any rights or powers held by any Person shall be attributed to any Connected Person to that Person; and (b) any rights or powers held by an Associate or Nominee of any Person shall be

attributed to that Person;

Any individual or entity with a significant interest cannot under any circumstances owns shares or have a holding in another club, rule I.5:

I.5. No Person may either directly or indirectly hold or acquire any Significant Interest in a Club while such Person either directly or indirectly holds any Holding in another Club

Therefore, it is clear that to purchase Everton, Textor has to sell his holding in Crystal Palace whether held directly or indirectly. As we’ve discussed before, the ownership and control of Crystal Palace is complex. It has been common knowledge that Textor has previously sought control of Crystal Palace by buying his major shareholders out. Whatever offers were made have been rejected. Equally Textor himself has rejected offers from his shareholders to buy him out.

A buyer for Textor’s Palace holdings?

However yesterday (11 September) Textor claimed the following in relation to selling his Palace holdings:

“We have two that have made what we believe are good qualifying bids. And we also still have the possibility that our partners may want it. They love the club as much as I do. And we are now down at the final week or two of believing we know who the buyer is gonna be.”

On the face of it, an advance, but with sufficient play room to question the degree of certainty within the statement.

The potential purchase of Everton

Again on the 11th September, Textor claims to have a “long stop date of like November 30th“. He adds further “that the documents I’m gonna have with Farhad are complete closing documents subject only to the Premier League approval.”

“And my challenge is making sure I get in early enough to really deal with that.” And yet, at the same time, as reported by Reuters, he admits “I’m in an awkward spot but we’re working through it. The awkward spot is that I can understand the club’s position … the accounting position,”

By virtue of his ownership of Crystal Palace he cannot possibly see all of the detail of Everton’s finances. Admittedly there’s scope for advisors to operate behind so-called Chinese walls, but the reality is that with the complexity of Everton’s finances, particularly the status and contract terms of the various debts with multiple creditors, it is impossible for him to concurrently hold his Palace shares whilst negotiating in detail, whilst refinancing in detail, Everton’s future.

Even if one accepted his assertion that the sale of Palace shares is reasonably close, the complexities of Everton’s finances must suggest that the Everton transaction goes way beyond the current published deadline date of 30th November with Farhad Moshiri. As a result, the probability of being able to influence the transfer window in January is in my opinion, minimal.

How would the Everton purchase (should it happen) be funded?

“You know, the acquisition of Everton, the potential acquisition of Everton would be funded by new equity that I’m investing.” An interesting comment by John Textor, that surely means that whatever the purchase price of Moshiri’s shares is, that will be funded by cash. It does not mean that Everton post purchase becomes debt free.

Everton owe external lenders approximately £650 million. With the debt cost conservatively estimated at £1.2 million a week this is a situation that needs resolving quickly. Again, one has to ask, how is this achieved given the restrictions or “awkward spot” Textor admits to.

How much of the existing debt and still future working capital requirements will be equity under Textor’s ownership? How much will be debt?

An interesting aspect of John Textor’s comment relates to the future ownership under John Textor.

“That contract, it’s very important to understand that contract as it’s being contemplated and drafted is with myself as the buyer, not Eagle Football Holdings in the UK, not Eagle Football Group in France.

So the buyer of Everton is John Textor, ostensibly. I hate to talk about myself in third person, but I’m trying to be clear. And so we’re forming a new holding company called Everton Football Group, and I’m the principal buyer of that group.

I have invited a couple of other friends with the terrific resources that will support that acquisition. It’s contemplated that be the majority shareholder of that small holding company. So expected to be highly collaborative with Olympique Lyonnais and the other clubs of Eagle Football Group, but legally very separate.”

A number of issues arise from this (i) Why seperate the purchase of Everton from the Eagle Football Holdings multi-club model and (ii) Who are the other investors?

This does seem odd, particularly at a time when John Textor (as reported by Sky Sports and other news outlets) is planning or seeking a listing of the Eagle Football Holdings Group. If the Everton acquisition was to go ahead outside of this group, any potential listing would comprise only of the interests in Brazil’s Botafogo de Futebol e Regatas, the Belgian club, RWD Molenbeek and Olympique Lyonnais. The existing Crystal Palace holdings would have been sold to facilitate the external (to the group) Everton purchase, and whilst the cash receipts would be retained in Eagle Football Holdings it’s difficult to see how the proposed listing valuation could be met with the three remaining clubs plus non-specified technology interests?

Whilst there’s an acknowledgement of close collaboration, this arrangement seems to fly in the face of previous comments re the benefits of the multi-club model. In my opinion, it further heightens the scope for issues surrounding conflicts of interests surrounding legal entities with not totally aligned ownership interests.

On the second point regarding the proposed Everton Football Group, who are the other investors and what delays would be created by those investors passing the Premier League’s directors and owners test?

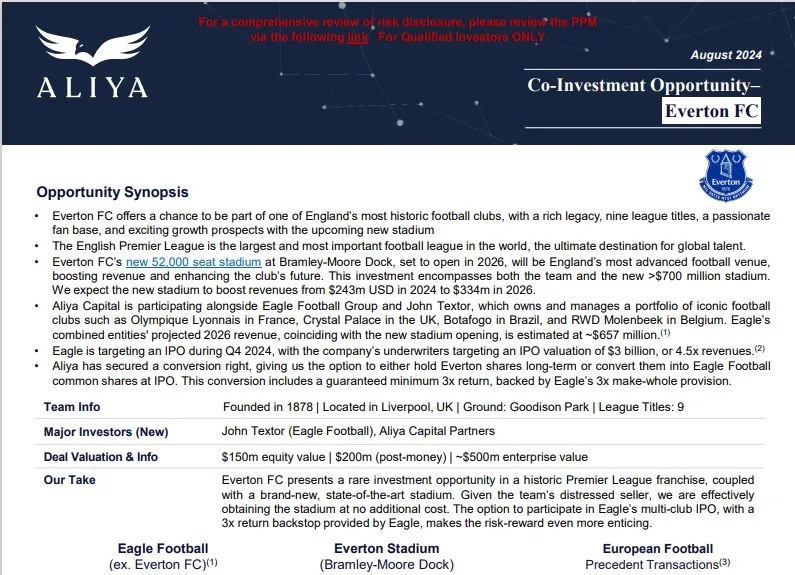

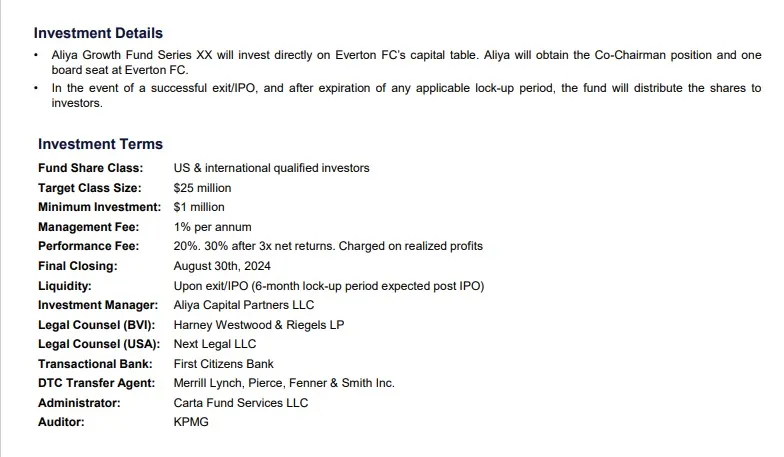

As if all the above does not raise enough questions – which again to be fair, John Textor may be able to provide perfectly adequate answers, then the emergence of an offering document dated August 2024, from Aliya Capital Partners from Miami, Florida seems to contradict much of the above.

Extracts from offering document:

I want to stress again, that scrutiny of potential purchasers and their offering is done from the perspective of examining what is best for our football club. It is particularly necessary given the experiences we have had with Farhad Moshiri. It’s also true that not every potential partner may have turned out badly, deals fail for multiple reasons.

It is true though that scrutiny should be welcomed by prospective owners, and in the case of John Textor who does appear approachable and willing to explain his position, he should, and I believe will, welcome the opportunity to further explain himself, his offerings and how they are funded.

Whether that leads to a successful purchase or not, is dependent upon many factors beyond his control. What is clear though is that significant barriers exist, not all answers are known and in the meantime Everton’s competitive and financial position worsens under Farhad Moshiri.

Reader Comments (1)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer ()

Add Your Comments

In order to post a comment, you need to be logged in as a registered user of the site.

Or Sign up as a ToffeeWeb Member — it's free, takes just a few minutes and will allow you to post your comments on articles and Talking Points submissions across the site.

How to get rid of these ads and support TW

1 Posted 13/09/2024 at 21:48:53

https://aliyacapitalpartners.com/